The more things change, the more they stay the same. I have written that the United States has a functioning multi-party system. With the Democrats, it’s mostly the more progressive bunch versus the more conservative bunch. Yes, it’s labor and LibDems in one party, oh joy! There is a more moderate faction, but they are mostly caught between both sides.

Now, corporate media will not go there, but I will. What is this palace intrigue about? Why is it that some democrats want to lose the whole enchilada to a fascist? I will have something to say about his acceptance speech later in this piece.

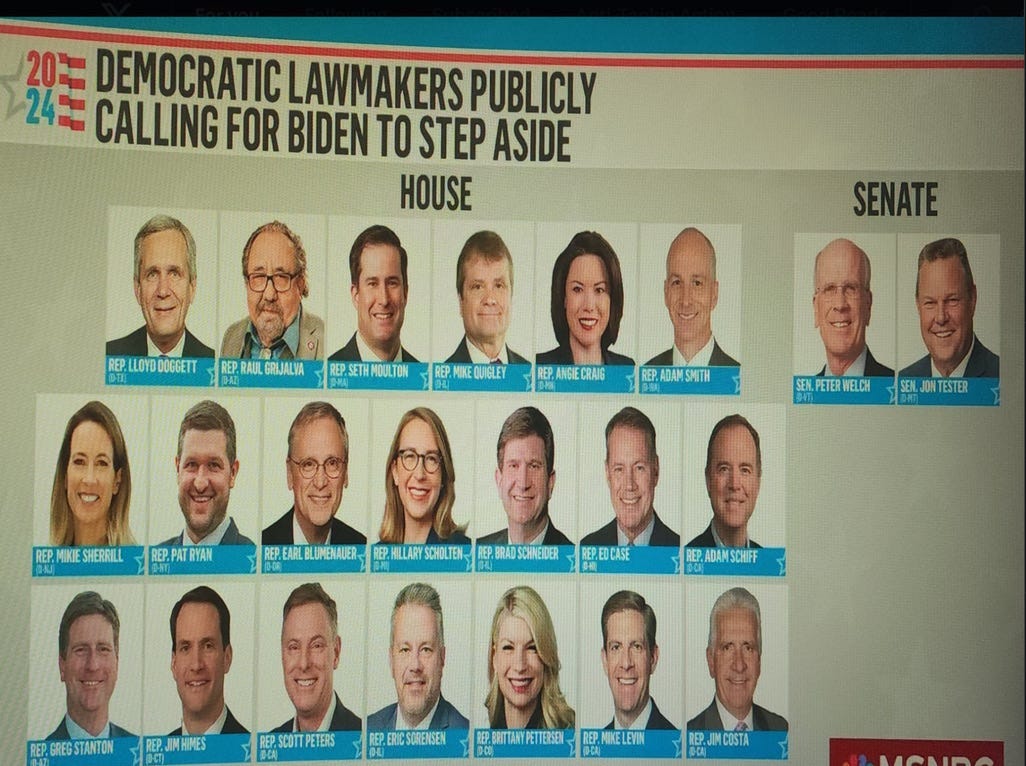

Let me introduce you to an old leopard with new spots. These guys, everyone calling for the president to drop out, are members of what, at one point, we used to call blue-dog Democrats. They became increasingly unpopular during the Bill Clinton years, and there have been a few efforts to change the brand during the last twenty years.

These days, sorry, guys. Some of us know who you are. They call themselves the New Democrat coalition. It’s cute. I gotta give them that.

Why did they become so damn unpopular during the Clinton years with a good percentage of the in-the-know Democratic base? In another era, some of these guys would be moderate Republicans. Yes, Scott Peters, I am looking at you.

He and Adam Schiff also have specific axes to grind with Kamala Harris, this takes me deep into the reporters notebook during the California Democratic Party Convention in San Diego in 2012. It’s been a while. Harris was the Attorney General of California and a clear rising star in the party. For the record, I have some disagreements with her on policy going to that time and covering local courts. They involve gang laws. Yes, some of her ideas (and my local DA) led to some crazy prosecutions of rappers. What I can tell for sure, though, is that she registered a little cold to the gaggle of reporters.

Fun fact: Most women in politics register a little cold because it’s still seen as a man’s game. Let me tell you about Nancy Pelosi, one of the coldest-feeling people I have ever had the pleasure of being in the gaggle for.

So, what are the axes? And this is from an outsider looking in. She was already a rising star. Some whispered she was going to be president someday. Peters was running for his first congressional term, and it struck me; the impression has never left me that he was a used car salesman. He comes from a well-connected family and has been involved in local politics for a while.

Peters, by the way, is also a member of the problem solvers caucus and will vote against democratic policies regularly.

However, the fact that Harris was on the fast track after serving in California state-wide politics rubbed people the wrong way. It’s also a NorCal vs SoCal, urban Bay Area versus rural California. Now, you know more about California politics than many others do.

Unlike all the propaganda from Republicans, the California Democratic Party trends somewhat conservative, with a small c, outside of urban minority cores. Harris is likely more conservative than the president, nowhere near where Peters or Schiff are. You don’t get elected to statewide office in this state as a firebrand—you don’t. But she is nowhere near where these people are.

I think this look into a long-buried reporter's notebook matters. It will explain why some of these folks want a brokered convention and a complete break with the Biden/Harris administration. She is in their way for their political ambitions. That’s the first thing.

But there is more.

It’s rumored that a second Biden administration will seek a reform to the tax code. They have been trying that for a while. This reform, I know—I have to feel sorry for the donor class—will, gasp, I know, raise their taxes.

We are not talking about less than 90 percent like FDR did or even 70 percent like JFK revised. We are talking about a few points. Here, from the White House:

Since taking office, President Biden has fought to build a fairer tax system that rewards work, not wealth; asks the wealthiest Americans and largest corporations to pay their fair share; and requires all Americans to play by the same rules and pay the taxes they owe. He has already secured historic legislation to make our tax code fairer, from enacting a corporate minimum tax so that billion-dollar companies can’t get away with paying $0 in Federal income taxes to giving the Internal Revenue Service (IRS) the tools it needs to make wealthy tax cheats pay the taxes they owe. President Biden will fight to stop Republican plans to add trillions to the deficit with tax cuts skewed to the wealthy and largest corporations. Republicans would rather add trillions to the national debt than take back even one dollar of the $150 billion annual rate cut corporations received under President Trump. Now, President Biden’s Budget will cut taxes for working families and lower deficits by trillions of dollars over a decade by making the wealthy and big corporations pay their fair share — and no one earning less than $400,000 per year will pay a penny in new taxes.

Makes Big Corporations and Special Interests Pay Their Fair Share

President Biden has secured major reforms to crack down on corporate tax avoidance and ensure that large corporations start paying more of their fair share, including a 15 percent corporate minimum tax and a surcharge on large, publicly-traded corporations that buy back their own stock. The President’s Budget builds on this progress by making big corporations pay their fair share in taxes and ending special interest giveaways. The President’s Budget:

Raises Tax Rates for Large Corporations. Corporations received an enormous tax break in 2017. While their profits soared, their investment in their workers and the economy did not. Their shareholders and top executives reaped the benefits, without the promised trickle down to workers, consumers, or communities. The President’s Budget would set the corporate tax rate at 28 percent, still well below the 35 percent rate that prevailed prior to the 2017 tax law. In addition, the Budget would raise the Inflation Reduction Act’s corporate minimum tax rate on billion-dollar corporations that the President signed into law from 15 percent to 21 percent, ensuring the biggest corporations pay more of their fair share. These policies are complemented by other proposals to incentivize job creation and investment in the United States to help ensure broadly shared prosperity.

Cracks Down on Tax Avoidance by Large Multinationals and Big Pharma. For decades, countries have competed for multinational business by slashing tax rates, at the expense of having adequate revenues to finance core services. Thanks in part to the Administration’s leadership, more than 130 nations signed on to a global tax framework to finally address this race to the bottom in 2021. Many of our international partners, including many of the world’s largest economies, have implemented or will soon implement this transformational agreement. The President’s Budget proposes to do the same by reforming the international tax system to reduce the incentives to book profits in low-tax jurisdictions, stopping corporate inversions to tax havens, and raising the tax rate on U.S. multinationals’ foreign earnings from 10.5 percent to 21 percent. These reforms would ensure that profitable multinational corporations, including Big Pharma, pay their fair share.

Denies Corporate Tax Breaks for Million Dollar Executive Compensation. Executive pay has skyrocketed in recent decades, with CEO pay averaging more than 300 times that of a typical worker in 2022. The 2017 tax law’s corporate tax cuts only made this problem worse, producing massive boosts to executive compensation while doing nothing for low- and middle-income workers. While corporations can choose to give huge pay packages to their executives, President Biden believes that they don’t deserve a tax break when they do. His Budget proposes new policy to deny deductions for all compensation over $1 million paid to any employee of a C corporation, which would discourage companies from giving their executives massive pay packages and help level the playing field across C corporations.

Quadruples the Stock Buybacks Tax. The Inflation Reduction Act’s surcharge on corporate stock buybacks reduces the tax advantage for buybacks over dividends and encourages businesses to invest in their growth and productivity as opposed to funneling tax-preferred profits to foreign shareholders. The President’s Budget proposes quadrupling the stock buybacks tax from one percent to four percent to address the continued tax advantage for buybacks and encourage corporations to invest in productivity and the broader economy.

Eliminates Tax Subsidies for Oil and Gas. The President is committed to ending tens of billions of dollars of Federal tax subsidies for oil and gas companies. Even as they benefit from billions of dollars in special tax breaks, oil companies have failed to invest in production. For the last two years, they have realized record profits, but instead of lowering prices for consumers or investing these funds, they have undertaken record stock buybacks, mergers, and acquisitions that benefited executives and wealthy shareholders. The Budget eliminates special tax treatment for oil and gas company investments, as well as other fossil fuel tax preferences.

Eliminates Tax Subsidies for Real Estate. The Budget closes the “like-kind exchange” loophole, a special tax subsidy for real estate. This loophole lets real estate investors — but not investors in any other asset — put off paying tax on profits from deals indefinitely as long as they keep investing in real estate. This amounts to an indefinite interest free loan from the Government. Real estate is the only asset that gets this sweetheart deal.

Eliminate Tax Subsidies for Cryptocurrency Transactions. The Budget eliminates a special tax subsidy for crypto currency and certain other transactions. Right now, crypto investors aren’t subject to the same rules of the road that investors in stocks or other securities have to follow, allowing them to report excessive losses. For example, a crypto investor — unlike an investor in stocks or bonds — can sell a cryptocurrency at a loss, take a substantial tax loss to reduce their tax burden, and then buy back that same cryptocurrency the very next day. The Budget eliminates this tax subsidy for crypto currencies by modernizing the tax code’s anti-abuse rules to apply to crypto assets just like they apply to stocks and other securities.

Makes Wealthy People Pay Their Fair Share

President Biden has already secured additional funding for the Internal Revenue Service (IRS) that is enabling it to crack down on the high-income individuals and corporations who too often avoided paying their lawfully owed taxes and to improve service for the millions of Americans that do pay their taxes. Already, the IRS has collected more than $500 million in unpaid taxes from fewer than 2,000 delinquent millionaires, launched enforcement action against 25,000 millionaires who have not filed a tax return since 2017, and started cracking down on high-end tax evasion like deducting personal use of corporate jets as a business expense. President Biden’s tax plan would build on this progress with reforms that will finally make the wealthiest Americans pay their fair share. The President’s Budget:

Requires Billionaires to Pay at Least 25 Percent of Income in Taxes. Billionaires make their money in ways that are often taxed at lower rates than ordinary wage income, or sometimes not taxed at all, thanks to giant loopholes and tax preferences that disproportionately benefit the wealthiest taxpayers. As a result, many of these wealthy Americans are able pay an average income tax rate of just 8 percent on their full incomes — a lower rate than many firefighters or teachers. To finally address this glaring inequity, the President’s Budget includes a 25 percent minimum tax on the wealthiest 0.01 percent, those with wealth of more than $100 million.

Increases the Top Tax Rate on the Wealthiest Americans to 39.6 Percent. One of the 2017 tax cut’s clearest giveaways to the wealthy was cutting the top marginal income tax rate from 39.6 percent to 37 percent, exclusively benefitting those in the top one percent. This rate cut alone is giving a couple with $2 million in annual taxable income a tax cut of more than $30,000 each year. The President’s Budget restores the top marginal tax rate to 39.6 percent for single filers making over $400,000 a year and married couples making more than $450,000 per year.

Ends Capital Income Tax Breaks and Other Loopholes for the Very Wealthy. The President’s Budget will end one of the most unfair aspects of our tax system — the fact that the tax rate the wealthy pay on capital gains and dividends is less than the tax rate that many middle-class families pay on their wages. Households making over $1 million — the top 0.4 percent of all households — will pay the same 39.6 percent marginal rate on their income just like a high-paid worker pays on their wages. Moreover, the Budget eliminates the loophole that allows the wealthiest Americans to entirely escape paying taxes on their wealth by passing it down to heirs. Today, our tax laws allow these accumulated gains to be passed down across generations untaxed, exacerbating inequality. The Budget will close this loophole, ending the practice of “stepping-up” the basis for gains in excess of $5 million per person and $10 million per married couple ($5.25 and $10.5 million, respectively, when combined with existing real estate exemptions), and making sure the gains are taxed if the property is not donated to charity. The reform is designed with protections so that family-owned businesses and farms will not have to pay taxes when given to heirs who continue to run the business. Without these changes, billions in capital income would continue to escape capital gains taxation entirely.

Requires Wealthy People to Pay their Fair Share Toward Medicare to Extend Medicare Solvency Indefinitely. The President’s Budget extends the solvency of the Medicare Hospital Insurance (HI) trust fund indefinitely by modestly increasing the Medicare tax rate on incomes above $400,000, closing loopholes in existing Medicare taxes, and directing revenue from the Net Investment Income Tax into the HI trust fund as was originally intended, along with dedicating an amount equivalent to the savings from Medicare prescription drug reforms. Current law lets certain wealthy business owners avoid Medicare taxes on some of the profits they get from pass-through businesses. The President’s Budget closes this loophole and raises Medicare tax rates on earned and unearned income from 3.8 percent to 5 percent for those with incomes over $400,000.

Closes Loopholes for the Wealthy. The Budget closes loopholes that overwhelmingly benefit the rich and big corporations, including ending the carried interest loophole that allows some wealthy investment fund managers to pay tax at lower rates than their secretaries, reforming tax preferred retirement incentives to ensure that the ultrawealthy cannot use these incentives to amass tax free fortunes, preventing the super-wealthy from abusing life insurance tax shelters, closing a loophole that benefits wealthy crypto investors, and ending a tax break for corporate jets.

Ensures That the IRS Can Continue to Collect Taxes Owed by Wealthy Tax Cheats. The Inflation Reduction Act addressed long-standing IRS funding deficiencies by providing stable, multi-year funding to improve tax compliance by finally cracking down on high-income individuals and corporations who too often avoided paying their lawfully owed taxes, and to improve service for the millions of Americans that do pay their taxes. Already, the IRS is using these resources to crack down on tax evasion by the wealthy and big businesses. It has collected more than $500 million in unpaid taxes from fewer than 2,000 delinquent millionaires, is recouping taxes from thousands of millionaires who did not fulfill their basic civic duty by filing a tax return, and is cracking down on high-end tax evasion like deducting personal use of corporate jets as a business expense. At the same time, the IRS is improving customer service and modernizing IT infrastructure. The President’s Budget would restore the full Inflation Reduction Act investment and provide new funding over the long-term to continue cutting the deficit by making sure that wealthy Americans and big corporations pay the taxes they owe through tax compliance initiatives and to continue improving service for taxpayers who are just trying to pay what they owe.

Cracks Down on Corporate Jet Loopholes. The Budget eliminates a tax break that gives preferential treatment for writing off corporate jet purchases, compared to commercial aircraft. It would also increase the fuel tax on corporate and private jet travel, so that corporate executives and other wealthy Americans pay their fair share for the use of airspace and other public services related to air travel.

Cuts Taxes for Working Families and the Middle-Class

President Biden’s tax cuts cut child poverty in half in 2021 and are saving millions of people an average of about $800 per year in health insurance premiums today. Going forward, in addition to honoring his pledge not to raise taxes on anyone earning less than $400,000 annually, President Biden’s tax plan would cut taxes for middle- and low-income Americans by $765 billion over 10 years. The President’s Budget:

Increases the Child Tax Credit for 66 Million Children. The American Rescue Plan’s expansion of the Child Tax Credit helped cut child poverty nearly in half to a historic low and narrowed racial disparities in access to the credit in 2021. The President’s Budget would restore the expanded Child Tax Credit, lifting 3 million children out of poverty and cutting taxes by an average of $2,600 for 39 million low- and middle-income families that include 66 million children. This includes 18 million children in low-income families who would be newly eligible for the full credit, and 2 million children living with a caregiver who is at least 60 years old. It would also provide breathing room for day-to-day expenses by allowing families to receive their tax credit through monthly payments.

Cuts Taxes for 19 Million Working-class Americans. By strengthening the Earned Income Tax Credit for low-paid workers who aren’t raising a child in their home, the President’s Budget would cut taxes by an average of $800 for 19 million working individuals or couples. That includes 2 million older workers age 65 and older and 5 million young adults age 18 to 24 who would be newly eligible for the credit.

Makes Lower Health Insurance Premiums Permanent. With enrollment in affordable health coverage at an all-time high, the President’s Budget would build on the remarkable success of the Affordable Care Act (ACA) and Inflation Reduction Act by making permanent the IRA’s expansion of the premium tax credit, which is saving millions of people an average of about $800 per year in health insurance premiums this year.

In addition, the President’s Budget explains his principles for addressing tax cuts expiring after 2025. The President would extend all middle-class tax cuts; as he has repeatedly promised, he will not raise taxes on anyone making less than $400,000 per year. And he will fully pay for these extensions with additional reforms to make the wealthy and corporations pay their fair share, so that they do not add to the debt. At the same time, he opposes tax cuts for the wealthy — either extending tax cuts for the top 2 percent of Americans earning more than $400,000 per year or bringing back deductions and other tax breaks for these households.

This is what this palace coup is about, and this is why donors are also closing their wallets. By the way, Donald Trump intends to do the opposite. He intends to shift the burden of taxation to the middle class, making our tax code even more regressive.

This brings me to the 25th Amendment.

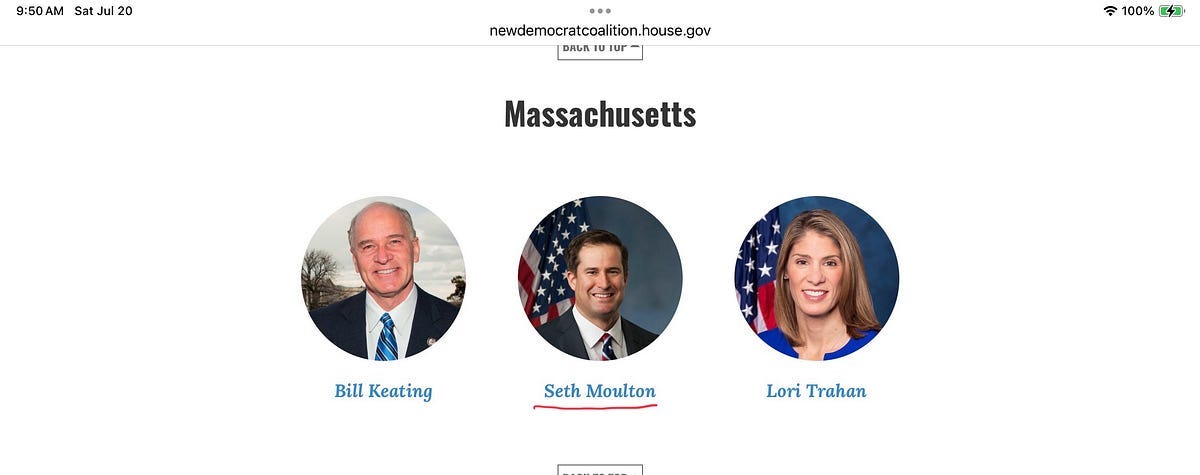

Representative Seth Moulton claimed the President did not recognize him at Normandy. Guess who is a blue dog by another name? Also, I don’t think the President would recognize a backbencher. For that matter, I have my doubts most of his constituents know who he is. Should all his constituents be tested for cognitive decline, too? By the way, from the New Democrat Caucus, notice something?

Are any of these people calling for this? Have you heard any mentions of the 25th Amendment? Me neither. Yes, Congress can go there.

The president can’t do the job if he does not recognize people. But legally removing him from office means the Harris and taxation problem these people want to go away does not go away.

Why this chaos? It’s not about the debate. For the record, I have watched more Biden since the debate than I have in a while. Yes, he has a stutter, but he is not stumbling. Yes, he has gaffes…he has had them for fifty years. He knows his stuff. The NATO presser, for example, was a tour de force on foreign policy.

This is about taxes. The people who donate to many of these back benchers don’t want their taxes to go up. Incidentally, it will also reduce income inequality. All these people are in for a new gilded age. It’s about keeping all those subsidies for the oil industry.

I don’t know about you, but would it be better to develop the electrical infrastructure needed for a green economy? But that’s just me. Making the tax code more progressive will also help lower the social temperature. But these people would rather lose it all.

Yes, they want a brokered convention. So what happened the last time we had one, in 1968? Hubert Humphrey lost in a Richard Nixon landslide. In 1980, when Ted Kennedy fractured the Democratic Party, Jimmy Carter lost.

These people have done more damage than Biden ever did to himself. It is not accidental. Once you see it, this makes sense. Some in the establishment want a second Donald J Trump administration. They believe it will be a disaster, but think of the ratings! Or think of those lower taxes for the donor class, which intersects neatly with the Uber wealthy. That’s their return on investment.

They also fantasize that we will continue to have regular elections. As a student of authoritarian systems, I am skeptical.

Trump

So, how about that acceptance speech? No, I did not watch it. I can’t stand to listen to the man. However, transcripts work…so I will be quoting the alarming part of the speech, at least to me. It’s textbook authoritarian, by the way. And for the record, he is one lucky man.

Here is the transcript. That way, we all play from the same sheet of music:

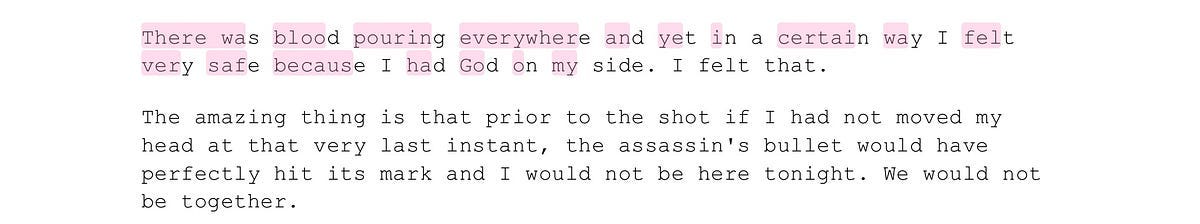

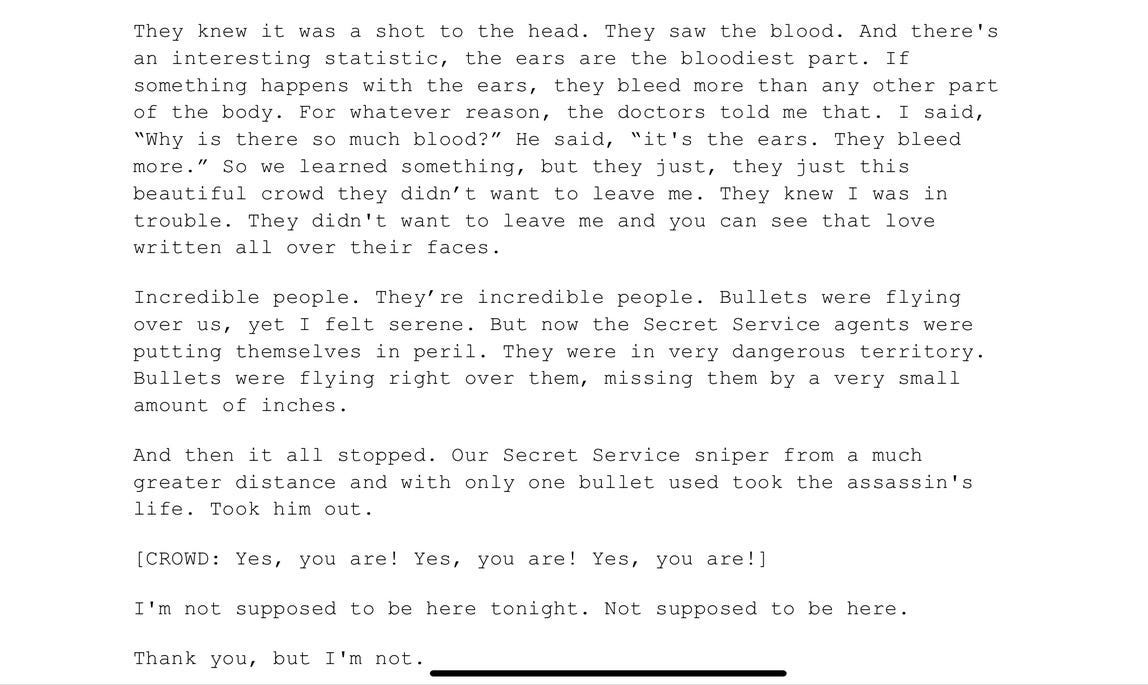

I want to concentrate on the screencaps. Yes, he was lucky. Also, another piece of data. It was glass until Trump posted himself on Truth Social that it was a bullet. But we are still waiting to hear from the campaign or the authorities. I will deal with this at the bottom as well:

Yes, it tells a dramatic story. And others who have been shot at and survived may call it providential. That’s not the point. The way he described this moment here is textbook authoritarian, using the event to wrap the crowd and make them believe he was chosen by divine power for a mission.

Every authoritarian uses this technique. It’s not new. It’s the strong man, now selected, for a purpose.

It is also not surprising that he returned to his stump speech, and there was zero unity. Now, let me deal with his reference to Hannibal Lecter. This time, he used the actual source, which he tends not to. Is he referencing what he wants to do with his enemies when he speaks of Lecter? And why is the media not even commenting on this?

Now, let me deal with the actual shooting and lack of transparency. If he had a bullet hit the ear, the standard of care includes imaging. I will not say he was falling asleep at the convention because of that. However, internal bleeds can do that. He has been falling asleep at important events since he was last president, like a NATO summit. But the corporate media should ask questions. And if they are and are hitting a stone wall….that’s your story. Why are they not leading with coverup at the Trump camp?

They also should point out that he is falling asleep. The fact that they don’t ask these questions, as they did during his New York trial, is one reason people are tuning them off. It’s so bad that the New York Times is now the gossip column. So why do they want Trump back? It’s good for business. Hey, CNN admits it.

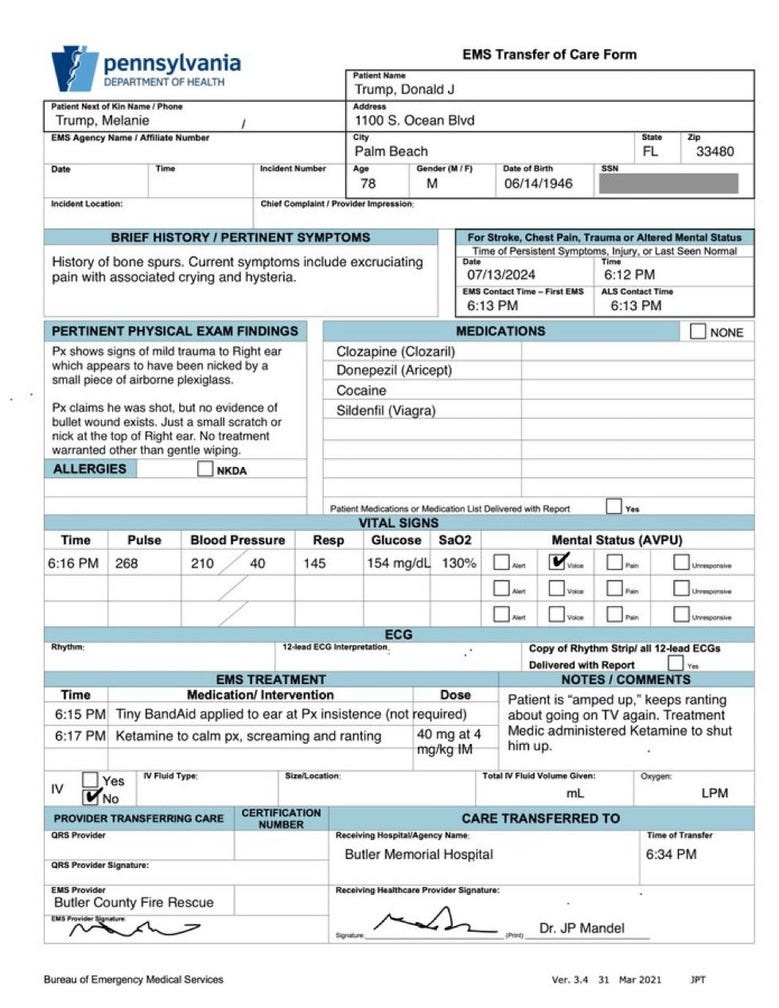

In the meantime, this hella fake EMS report is making the rounds. If you have ever dealt with patient care, it’s funny. If you never did, you might buy it as accurate. And the conspiracies are all over the place. They range from this never happened, to it was staged, to crisis actors. If he were killed, it would make the Kennedy assassination conspiracy cottage industry finally end. It just might.

Any transparency would be welcome. They cannot put that horse back in that barn, though—at least, I don't think so. The theories are hardening, and chaos also helps Trump.